“An investment in knowledge pays the best interest.” – Benjamin Franklin

THE STEPS TO ACHIEVE INCOME GROWTH & FINANCIAL SUSTAINABILITY

- get your FREE online charity/NFP financial health check

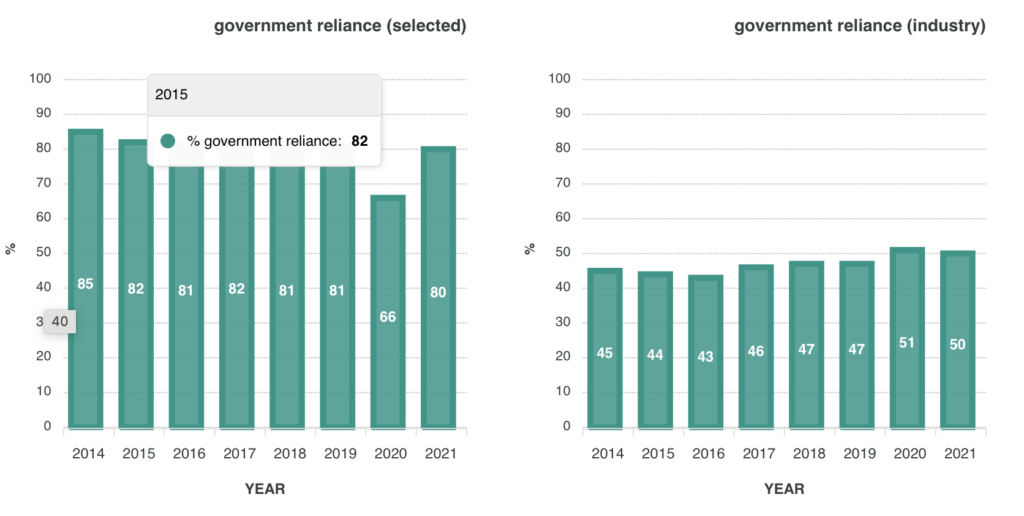

gain insights about your charity’s financial strengths and areas for improvement. benchmarking allows you to compare your performance against the charity sector and make informed decisions for financial growth and sustainability. this powerful online tool for subscribers draws on ACNC data over the last decade.

- request a customised, comprehensive financial benchmarking report and FREE consultation

better charity will prepare a customised, comprehensive benchmarking report comparing your charity against your peers using a range of industry variables (income, staff, sector etc), plus a FREE consultation.

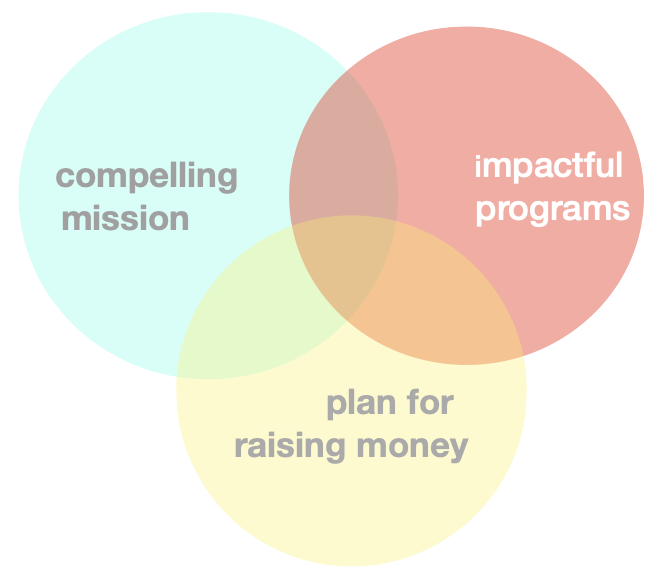

above: aligning your mission, core competencies and money-raising activities

- assess your ability to attract income (and the right kind of income) for your mission

charities that invest in long-term capacity-building and infrastructure create the foundations for income growth and enduring impact. an income growth assessment analyses the alignment of your money, mission and marketing to bolster your money-raising capabilities.

- avoid the charity insolvency trap, get help before it’s too late!

ACNC Governance Standard 5 requires ‘responsible people’ to prevent a charity operating while insolvent (similar to duties outlined in the Corporations Act 2001). warning signs of insolvency include late payments, ongoing financial losses and difficulties in producing timely and accurate financial information.

In contrast, strategic factors for a financially sustainable charity include strategically aligned programs, income diversity, strong funding relationships, external market positioning, good financial management, governance, and effective communication.

If the risk of insolvency looms, ‘responsible people’ are urged to seek timely professional advice and explore avenues to enhance income or manage costs. If it’s too late to intervene, you made need to explore voluntary administration, or – as a last resort – liquidation.

a failure to prevent insolvent trading could result in severe penalties, including compensation, criminal charges, civil penalties and director penalty notices.

HOW DOES A CHARITY ASSESS ITS FINANCIAL STRENGTH?

by monitoring and analysing financial statements, ratios and indicators, charities can gain insights into their financial health, identify areas for improvement, and make informed decisions to ensure financial sustainability in achieving their mission. this includes

profit and loss (income) statement: shows the organisation’s revenues, expenses, and net income over a specific period.

balance sheet: a ‘snapshot’ of the organisation’s assets, liabilities, and net assets (equity) at a specific point in time.

cash flow statement: shows the cash generated or used by the organisation’s core operations. a positive operating cash flow is generally a positive sign.

budget variance analysis: regularly compare actual financial results to the budget (planned results) identifies issues to inform corrective actions.

benchmarking: assess your charity’s financial performance against industry or sector averages.

external audit: external auditors annually review the financial statements and controls to provide an additional layer of assurance and transparency.

finance committee: a board committee comprising of directors and advisors with finance and governance skills, the committee provides expert oversight and advises the Board on finance issues independently of the executive staff.

attracting money to supercharge your mission

moving from nonprofit scarcity to financial sustainability

as a charity or nonprofit leader, you face many funding challenges. it could be expanding services to meet growing demand. or vital income sources drying up. or your people are over-stretched and your systems outdated.

you need to raise more funds, but the roadmap to sustainability is unclear. the money is there, it’s just not reaching your mission and programs … yet.

it is essential that nonprofit leaders and boards understand the importance of cash flow management and long-term planning for financial growth and sustainability.

financial sustainability occurs when your nonprofit can attract and deploy enough funds to achieve your long-term goals. better charity is a boutique charity consultant offering the following services to become more financially sustainable:

- a financing plan to connect your strategy with money and bring more income through the door. this approach optimises and aligns all your money-raising activities, including fundraising

- challenging and controlling nonprofit program costs to ensure all your activities are mission rich and financially sustainable

- a compelling Case for Support which articulates why your charity needs and deserves philanthropic support

- a FREE financial health check to benchmark your nonprofit against sector averages

- a FREE grant finder to research mission-aligned funders

- a FREE AI-powered grants writer to compose compelling grant proposals aligned to the grants guidelines and criteria

- contingency and scenario planning to prepare for difficult economic conditions or loss of funding

- setting funds aside to cover unexpected or sudden costs (i.e. a financial ‘reserve‘ for ‘tough times’)

- training to ensure the board is financially literate and can fulfil their fiduciary duty as directors

- training for board directors and staff to actively champion your strategy to funders and change makers.

better charity can help you develop a financing roadmap, as a coach or facilitator, to scale your social impact. if you would like to learn more, please contact better charity for a free consultation and additional information.

when financing goes wrong … common mistakes

a good financing plan for your charity or nonprofit organisation connects your strategy with your money-raising efforts. tell tale signs of financial trouble include::

- not having a plan – this is ‘magical thinking’ where everyone hopes money will appear without organising your people and systems around your mission.

- a one year plan – if you enjoy lurching from year to year fighting money-related crises, this is the way to go. you really need to plan for 3 to 5 years to put your charity on a sound financial footing for the future.

- over-reliance on one income source … is a recipe for a financial crisis. your money strategy should include all relevant sources of income, not just fundraising, grants or membership (which is arguably a governance program not a funding source). diversifying income allows you to spread risk and grow revenue.

- not knowing how much your strategy costs – your multi-year strategic plan should be fully-costed with a plan to attract money (and the right kinds of money). this includes funding for both your operational (people, programs) and capital (systems, assets) costs.

- a cultural aversion to raising money – if your board and staff believe raising money is the sole responsibility of fundraising staff, your charity will fail to realise its potential. everyone should be an ambassador for raising money for your mission, starting at the top (the board).

- your legacy programs are untouchable – a failure to axe costly loss-making ‘legacy’ programs that are high in emotional connection but mission poor will starve your high impact programs of money and stall your charity’s growth.

- every funding dollar is directed to projects – you and your funders are creating a culture of ‘scraping by’ which fails to invest in people and systems. this self-defeating mentality will diminish your charity’s impact.

- an endowment fund is a secure income source … it can also be an inefficient use of money. imagine if those funds were invested in digital systems and talented people to raise money. the returns will dwarf annual interest income from an endowment fund and allow you to scale your social and environmental impact.

- raising capital for a new building … i’m getting this a lot from small (particularly faith-based) charities who want the security of owning their own property. see endowment fund above, except with the added cost of building utility bills, rates and maintenance costs. think hard before this one.

SOCIAL AND ENVIRONMENTAL

IMPACT

how should a charity or NFP assess its financial strength?

by regularly monitoring and analysing financial statements, ratios and indicators, charities and NFPs can gain insights into their financial health, identify areas for improvement, and make informed decisions to ensure financial sustainability in achieving their mission. this includes:

profit and loss (income) statement: shows the organisation’s revenues, expenses, and net income over a specific period. look for income diversity and continuity risks, trends, ratios and budget variances (i.e. over-spends). ensure you are charging enough indirect costs to programs to cover investment in your people and systems.

balance sheet: this is a ‘snapshot’ of the organisation’s assets, liabilities, and net assets (equity) at a specific point in time. look for trends, budget variances and ratios. you must have enough ‘liquid’ assets (that can be converted into cash) to cover short-term liabilities. fixed assets and investments should be contributing to your mission. make sure you understand your net assets:

- unrestricted net assets (net assets not subject to donor or grant-imposed restrictions) provide flexibility for the organisation to address its priorities. ensure you have enough ‘free reserves’ to cover unexpected challenges.

- temporarily restricted net assets: understand the nature and timing of restrictions on net assets, and ensure compliance with donor intentions.

- permanently restricted net assets: net assets that are permanently restricted, such as an endowment fund. ensure adherence to donor restrictions.

cash flow statement: shows the cash generated or used by the organisation’s core operations. a positive operating cash flow is generally a positive sign. produce a long-term forecast of the organisation’s cash flow, considering both internal and external factors, to track and assess financial sustainability.

budget variance and ratio analysis: analyse ratios and regularly compare actual financial results to the budget (planned results) identify issues to inform corrective actions and update the forecast result for the financial year.

external audit: external auditors annually review the financial statements and controls to provide an additional layer of assurance and transparency. review and address any findings or recommendations from external auditors.

finance committee: a board committee comprising of directors and advisors with finance and governance skills, the committee provides expert oversight and advises the Board on finance issues independently of the executive staff.